This Institute for Housing Studies (IHS) Cook County House Price Index highlights changing prices for single-family homes through the fourth quarter of 2023 in 17 City of Chicago submarkets and 18 submarkets primarily in suburban Cook County. This Price Index is the first that uses submarkets based on the 2020 U.S. Census PUMA boundaries. The 2020 PUMA boundary updates improve the Price Index analysis as the new submarkets group Cook County suburban municipalities and Chicago community areas better reflect groupings of areas with similar market characteristics. A map of the new boundaries can be found here. A detailed discussion of the Index is below. To view a full-page interactive graph with a map and data for all submarkets go here. Underlying price index data can be found here.

This analysis showcases the ongoing implications of high interest rates and economic uncertainty on local housing markets. The Index indicates that three Cook County submarkets experienced year-over-year price declines in the fourth quarter of 2023. Despite these drops, all Cook County submarkets had price levels that were higher in the fourth quarter of 2023 when compared to the first quarter of 2020 due to strong price growth experienced in the early pandemic. Future Cook County Price Index updates will help policymakers and practitioners understand the endurance of pandemic-era price gains in Cook County submarkets as market factors change.

Key Findings

Year-over-year price changes

- Areas with the largest increases in single-family sales prices between the fourth quarters of 2022 and 2023 include Chicago submarkets Uptown/Rogers Park (18.2 percent increase) and Auburn Gresham/Morgan Park (13.7 percent). In suburban Cook County, the largest annual increases were seen in Palatine/Barrington (15.1 percent increase) and Mount Prospect/Elk Grove Village (12.8 percent increase).

- Since the fourth quarter of 2022, three submarkets in Cook County experienced year-over-year declines. All of these submarkets are located in the City of Chicago: Bronzeville/Hyde Park (10.4 percent decline), South Chicago/Hegewisch (2.5 percent decline), and Lincoln Square/North Center (2.5 percent decline).

- On average, house prices in Cook County increased by 5.2 percent compared to the previous year. In the City of Chicago, price levels increased by 5.1 percent, and in suburban Cook County prices increased by 5.4 percent.

- The map below highlights the pattern of price changes in submarkets between the fourth quarters of 2022 and 2023. Click on each submarket area to get additional data on house price trends. To view a full-page, interactive map, click here.

Figure 1. IHS Price Index, 2023Q4 Year-Over-Year Price Change

COVID-19 pandemic start (2020Q1) to current

- Since the start of the pandemic, house prices across the county have increased significantly due to soaring demand and a limited supply of homes. In Cook County, though all submarkets saw growth from the first quarter of 2020 to the fourth quarter of 2023, this growth has varied.

- Areas with the largest increases include much of suburban Cook County as well as City of Chicago submarkets where single-family homes sell for prices below the citywide median. These areas include south suburban Chicago Heights/Park Forest and Calumet City/Harvey where single-family house prices increased by 69.9 and 65.4 percent, respectively. In Chicago, gains were highest in Englewood/Greater Grand Crossing (76.0 percent), South Chicago/Hegewisch (61.7 percent), and Chatham/West Pullman (60.6 percent).

- The smallest gains in single-family house prices were found in submarkets in Chicago. The smallest growth was in Lake View/Lincoln Park (14.4 percent), followed by Bronzeville/Hyde Park (15.9 percent), and West Town/Near West Side (16.1 percent). In the suburbs, the smallest growth was found in Winnetka/Northbrook (29.3%) and Oak Park/Brookfield (29.7%).

- House prices in Cook County increased by 39.3 percent since the beginning of the pandemic. In the City of Chicago, prices rose 37.9 percent compared to 40.2 percent in suburban Cook County.

- The map below highlights the pattern of price changes in submarkets from the first quarter of 2020 to the fourth quarter of 2023. Click on each submarket area to get additional data on house price trends. To view a full-page, interactive map, click here.

Figure 2. IHS Price Index, COVID-19 to 2023Q4 Price Change

Recovery from bottom

- As of the fourth quarter of 2023, all submarkets in Cook County have experienced at least a 36.9 percent price increase compared to their lowest post-recession price level. Areas with the largest increase from price bottom include Englewood/Greater Grand Crossing (238.0 percent) and South Lawndale/Brighton Park (227.7 percent).

- The smallest recoveries were seen primarily in suburban Cook County. The suburban area with the weakest recovery is north suburban Winnetka/Northbrook where prices increased by 50.7 percent from its price bottom. This small growth is largely because suburban submarkets are generally more stable than many submarkets in the city, and thus have less dramatic price peaks and valleys. In Chicago, the smallest recovery was in Lake View/Lincoln Park, at 36.9 percent. However, this submarket is the only area in Cook County that did not experience dramatic price declines during the recession. Therefore, this small recovery is an indicator of stability and consistently high prices; as of the fourth quarter 2023, the median sales price for a single-family home in the Lake View/Lincoln Park submarket was $1,390,500.

- House prices in Cook County have recovered by 100.6 percent from the bottom of the market. In the City of Chicago, prices have rebounded by 114.8 percent compared to 95.9 percent in suburban Cook.

Peak to current

- With the exception of Bronzeville/Hyde Park submarket in Chicago, all house prices in all submarkets in Cook County were above their pre-Great Recession levels in the fourth quarter of 2023.

- Price levels in Cook County at large and suburban Cook are 15.8 and 16.8 percent above previous peak levels last seen in 2007, respectively. Price levels in the City of Chicago are 16.3 percent above peak levels, although there continues to be substantial variation among City of Chicago submarkets.

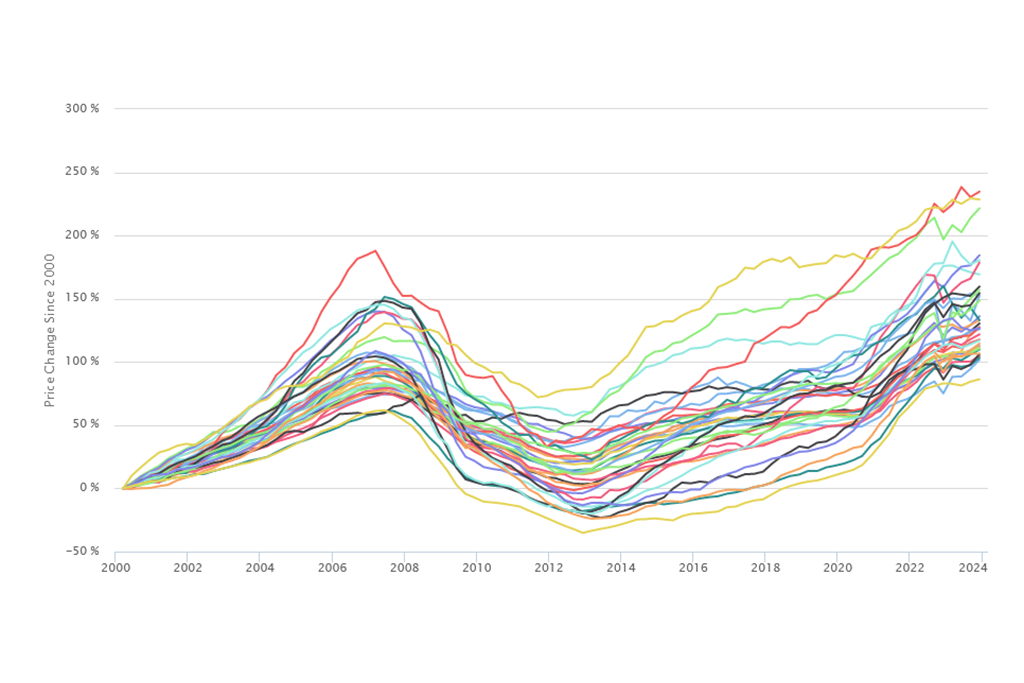

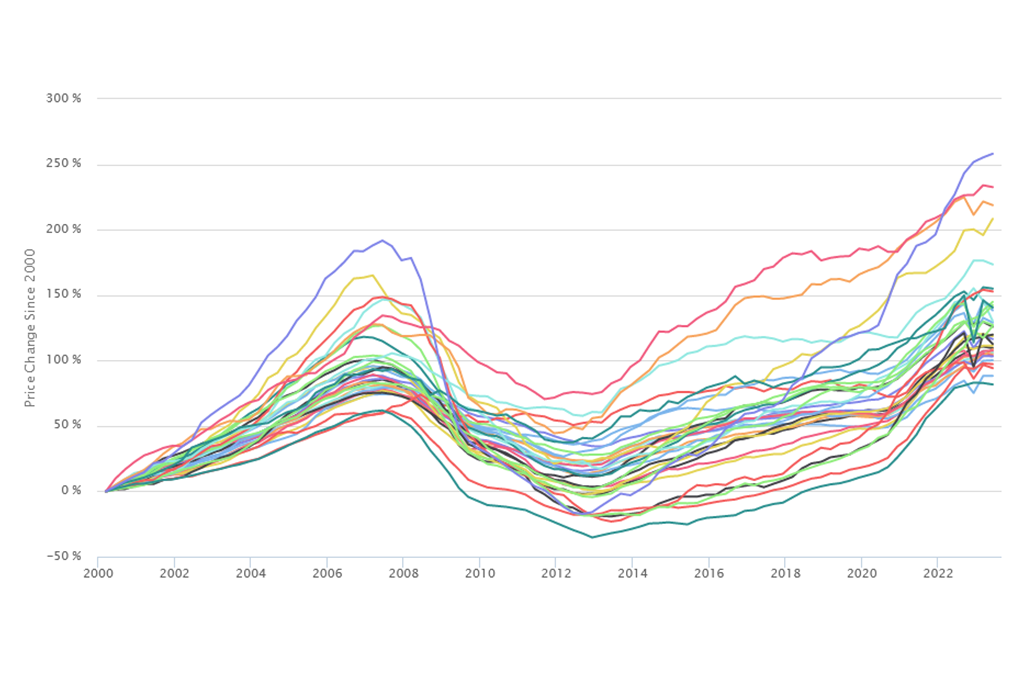

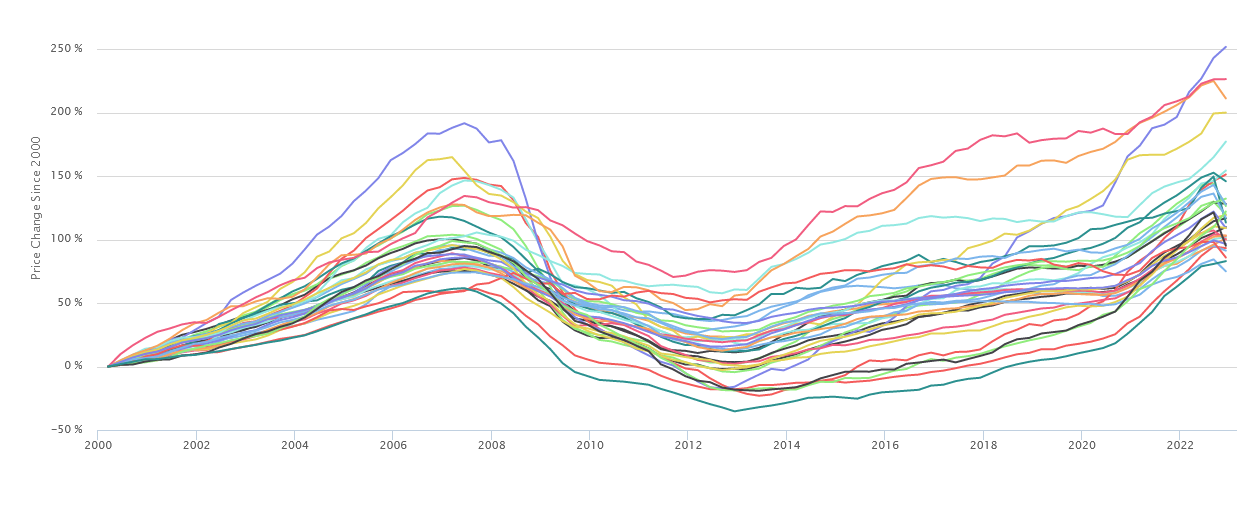

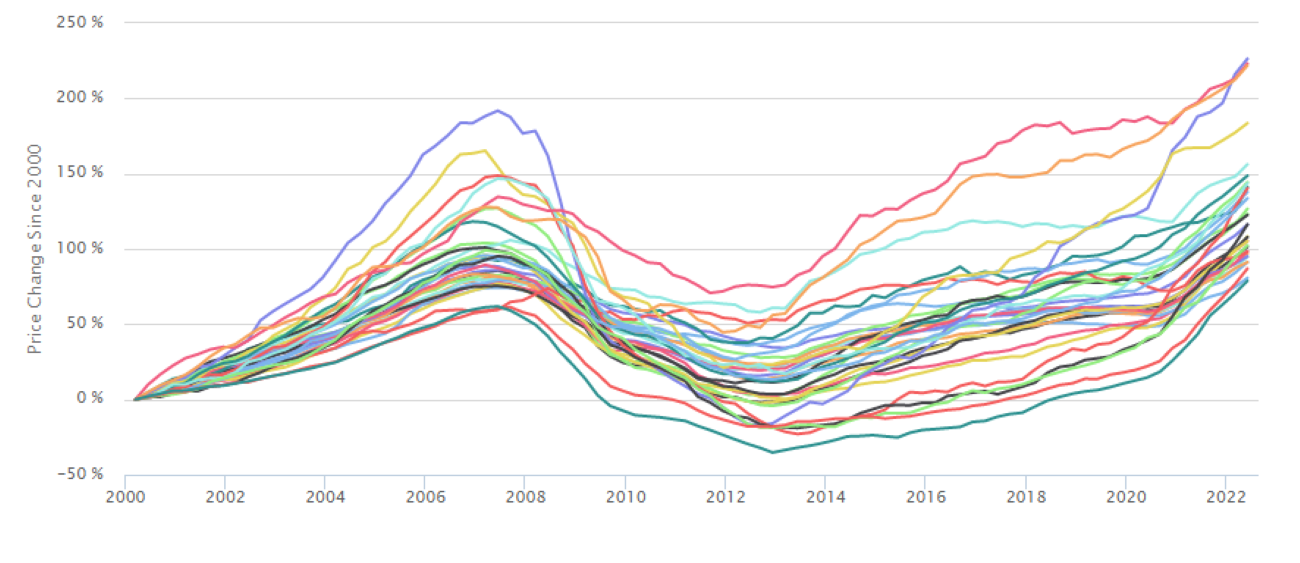

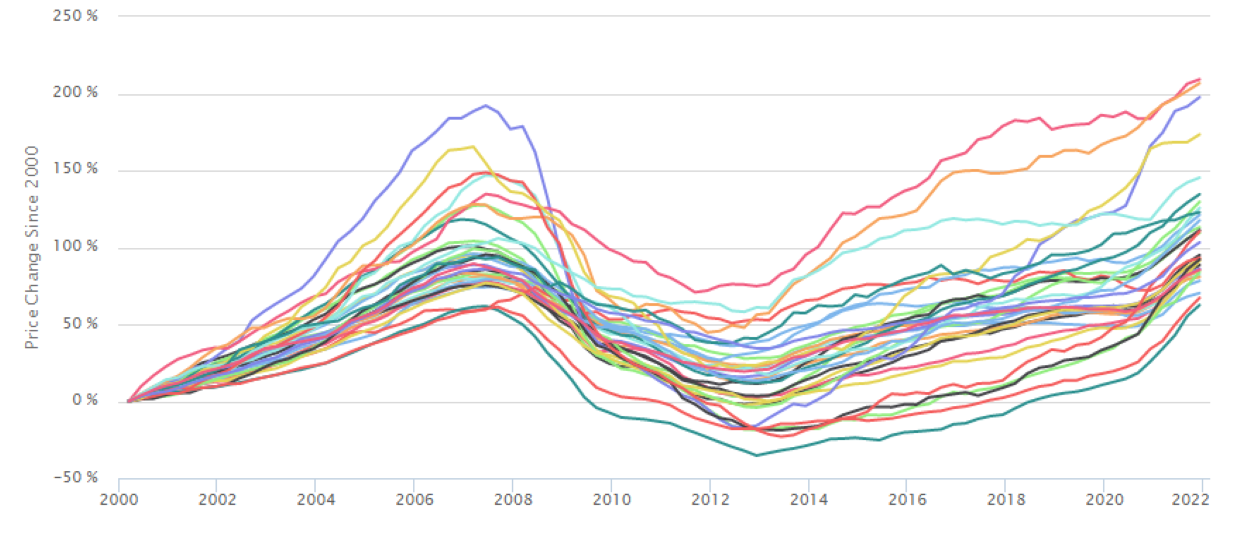

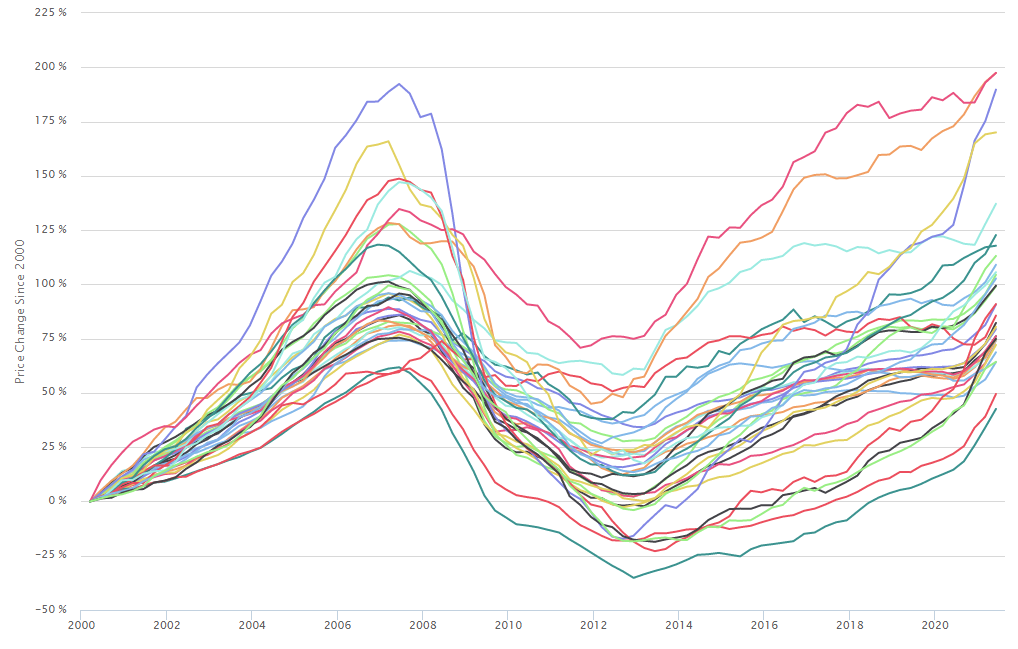

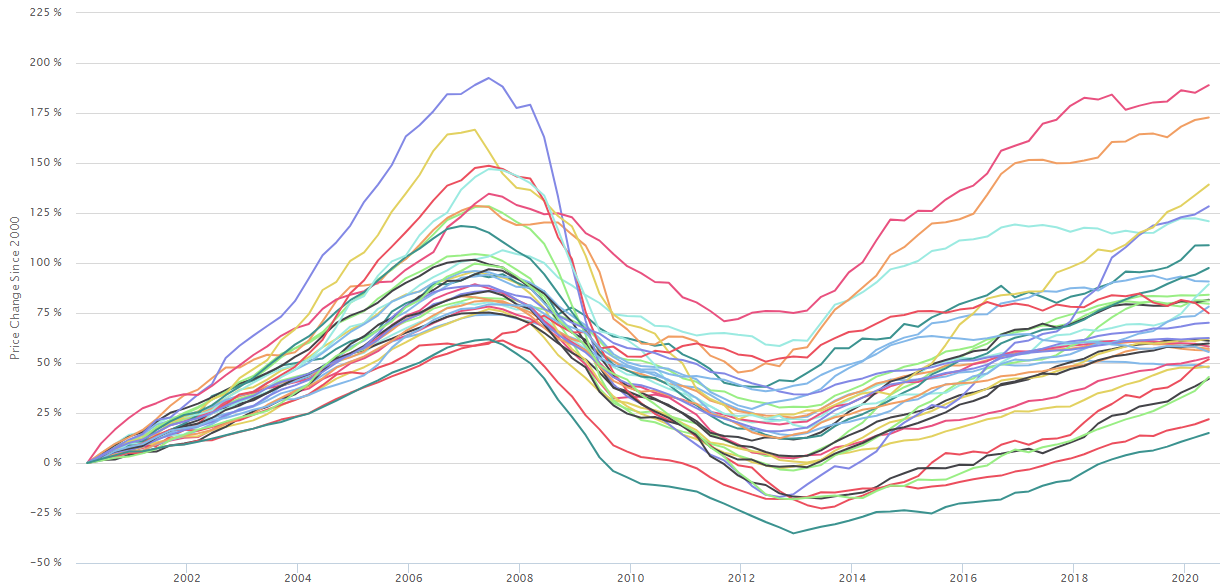

Price changes since 2000

- All submarkets in Cook County have had prices above their 2000 levels since at least the latter half of 2018. As of the fourth quarter of 2023, long-term price gains since 2000 were lowest in Calumet City/Harvey at 86.3 percent. The smallest post-2000 price gains within the City of Chicago were in Lake View/Lincoln Park, which were 106.3 percent higher.

- As of the fourth quarter of 2023, price levels in three Chicago submarkets were more than 200 percent of what they were in the year 2000. These submarkets are: Bridgeport/Lower West Side (234.7 percent), West Town/Near West Side (228.5 percent), and Logan Square/Irving Park (221.5 percent).

- House prices in Cook County have increased by 115.6 percent since 2000. In the City of Chicago, prices have increased by 145.6 percent compared to 106.0 percent in suburban Cook County.

To view a full-page interactive graph with a map and data for all submarkets go here. Underlying price index data can be found here.

Background on Price Indices

House price trends are one of the most important indicators of a neighborhood’s economic health. In recent years, a substantial focus has been paid to the importance of house price trends as a national or regional indicator of economic conditions, but growing attention is being paid to the implications uneven price declines and recoveries across neighborhoods have for communities and their residents. Neighborhoods with rapidly rising prices may be those facing current or future housing affordability concerns, while areas with slow price recovery may need strategic investment to rebuild demand for housing.

Additionally, the uneven nature of house price declines and recovery across neighborhoods is a stark illustration of the growing divide between thriving and struggling communities and households. Home equity is one of the key vehicles for families to build wealth, and the variation in price trends—which can be used to estimate levels of potential home equity gained and lost by households and neighborhoods over time—can be an indicator of household financial conditions across communities.

To help housing stakeholders, policymakers, and the public understand this issue better, the Institute for Housing Studies (IHS) has developed a Cook County house price index to track quarterly price trends for single-family homes in 17 submarkets in the City of Chicago and 18 submarkets in suburban Cook County.

More about IHS' Cook County Submarket Indices

The submarkets in IHS’s price index are based on Public Use Microdata Areas (PUMAs) from the 2020 US Census. These submarkets are different from previous IHS’ price index which were based on Public Use Microdata Areas (PUMAs) from the 2010 US Census. Compared to the previous versions of Cook County submarkets, the updated submarkets include changes in geography and name of existing submarkets as well as 1 additional Submarket within suburban Cook County and 1 additional submarket within the City of Chicago. Consequently, there are now 17 submarkets in the City of Chicago and 18 that are primarily in suburban Cook County.

In the City of Chicago, the submarket surrounding the Loop has been excluded because of insufficient levels of single-family home sales. Click here for a reference guide to the community areas and suburban municipalities found in each submarket. Additional detail about the model can be found at the end of this analysis.

The discussion below highlights four key metrics for analyzing house price trends and describes their patterns and their implications for communities:

Year-Over-Year – This metric illustrates the short-term price trend and compares the current price level as of the fourth quarter of 2023 with the price level in the fourth quarter of 2022. Submarkets with large changes in price levels can be very different relative to each other, but each demonstrates recent increased demand. These include highly foreclosure-distressed areas where prices are starting to recover, as well as rapidly appreciating ‘hot’ markets. Historically, strong markets tend to have low but steady appreciation year over year. Interpreted in conjunction with other price trend indicators, year-over-year price changes can help identify rebounding markets with stabilizing prices.

COVID-19 Pandemic Start to Current – Introduced in the second quarter 2023, this is a key indicator of the degree to which housing demand has shifted since the beginning of the COVID-19 pandemic as well as the variation in this experience across Cook County submarkets. This metric examines changes in house prices from the first quarter 2020, roughly the beginning of the COVID-19 pandemic, to the fourth quarter 2023. The COVID-19 pandemic and the various emergency public health restrictions implemented to contain the virus, sharply impacted both the broader economy and housing markets across the country. Increased unemployment, rising rents, and the economic downturn led to heightened inequality and housing insecurity for many. At the same time, historically low interest rates and shifting preferences for living in single-family homes led to increased demand for housing, particularly from higher income households. Coupled with a limited supply of homes for sale, house prices quickly rose to new highs. This indicator will help track how house prices in Cook County submarkets are impacted by factors such as interest rate increases, affordability pressures, and other changing market conditions.

Recovery from Bottom – This metric measures the change in the price level from a submarket’s lowest point after the 2008 collapse of the housing market to the fourth quarter 2023 and tracks the speed of recovery of single-family house prices. This indicator is an important measure for recent buyers who purchased properties near the bottom of the market and who are trying to understand the return on that investment. The indicator is also valuable for understanding where investment has been flowing since the bottoming out of the market. This ‘recovery’ metric reflects recent demand for housing that could be driven by owner-occupants competing for a limited supply of for-sale housing in “hot” markets or investors competing for the dwindling supply of low-cost properties in more distressed markets. The difference in types of demand means the recovery metric should be interpreted in conjunction with other price trend data points.

Peak to Current – This metric measures the difference between a submarket’s peak price level at the height of the housing boom and the current price level as of the fourth quarter 2023, and it captures the recovery of a neighborhood’s house prices toward previous price peak levels. Many neighborhoods that saw a substantial build-up in prices during the housing bubble experienced equally dramatic declines. While those price peaks were often inflated and unsustainable, recovery towards those peaks is an important benchmark for homeowners who bought their homes or obtained a mortgage from 2005 to 2007 when prices were at their highest. Many homeowners are reluctant to sell their homes for less than what they paid, and, in cases where a mortgage is involved, areas that are well below previous peak values are likely to have larger numbers of underwater or near-underwater homeowners. Owing more on a mortgage than what a property is worth limits an owner’s ability to sell their property and puts a greater strain on a household’s financial conditions. As values get closer to previous peak levels, more homeowners are likely willing and able to sell, more households will exit underwater status, and equity lost during the housing crisis will likely be rebuilt. In areas where values remain well below peak levels, many homeowners likely remain underwater.

Price trends since 2000 – This metric tracks the change in price levels from the first quarter of 2000 to the fourth quarter 2023 and measures long-term price trends. The variation in neighborhood price trends since 2000 is a key indicator of the impact the housing crisis and uneven housing recovery has had, not just on local housing markets, but also on long-term homeowners. Home equity is a key asset for both lower- and higher-income households, and increasing equity over time is one of the ways that both lower- and higher-income households build wealth. In areas where there has been limited long-term price appreciation, long-time owners benefit less from increasing home equity compared to long-term owners in areas with significant appreciation.

The Model

Using its data clearinghouse, IHS has developed a hedonic price index model to provide a stable mechanism to track submarket-level price trends. Unlike a repeat sales model which requires a matched pair of sales on a single property and can be less stable at smaller geographies, a hedonic model combines data on a property’s sales price with data on the physical characteristics of that property and its location relative to key amenities or disamenities. The statistical model controls for factors that contribute to price and allows for the development of an index tracking price changes of the typical, non-distressed home over time and is ideal for tracking price trends at the submarket level. For more information on IHS’s hedonic price index model, click here, though note that while this document is based on the outdated 2010 PUMA boundaries, the methodology to calculate price changes is the same.