Among the key findings from IHS’s recently released State of Rental Housing in Cook County report was that while the supply of rental units in Cook County increased between 2007 and 2011 to meet observed increases in rental demand, the gap between the supply of and the demand for rental housing affordable for lower-income renters grew. Why did increases in the supply of rental units not slow the growth of this affordability gap? This post takes a closer look at what drove the increases in both rental demand and supply to help answer this question.

Between 2007 and 2011, both the City of Chicago and suburban Cook County saw growth in renter households and declines in owner-occupied households. This growth in renter households was largely driven by lower-income renters. In the City of Chicago, the number of renter households increased by 10.3 percent, with renters making less than 50 percent of the area median income (AMI) accounting for nearly 70 percent of that increase. Comparatively, renters making less than 50 percent of AMI accounted for nearly all of the 11 percent growth in renter households in suburban Cook County.

During the same period, both the City of Chicago and suburban Cook County saw an increase in their stock of rental housing to meet this increased demand. However, despite this increase in supply, the gap in the supply of rental housing affordable to lower-income households grew.

We define a renter needing affordable rental housing as a renter household earning 150 percent of the poverty level or less. In 2011, this would mean any renter household earning $34,532 or less. An affordable unit for that renter is one where they pay 30 percent or less of their monthly income towards rent. In 2011, for instance, the monthly gross rent for a unit that would be affordable for such a renter would be $863.29. Any renter household at this income level paying more than 30 percent of their monthly income toward rent would be considered rent-burdened.

The State of Rental Housing report concluded that between 2007 and 2011, the gap between the demand for and supply of affordable rental housing grew by 8 percent in the City of Chicago and by over 25 percent in suburban Cook County. This mismatch means that more lower-income renters are paying a higher share of their monthly income toward rent. In Cook County, the number of these rent-burdened households grew by nearly 14 percent and across all income groups.

Some of this gap may be due to the type and corresponding rents of rental units that make up the increase in supply. In both the City and the suburbs, the largest growth in rental units was seen in rental units in single family homes. In many cases, investor buyers purchased these homes, which were likely intended for owner-occupancy, and converted them to rental in order to meet the growing new demand. In the City, the supply of rental units grew by 9.6 percent, with 21.2 percent of this increase made up of single family homes. In suburban Cook County, the supply of rental units grew by 10.5 percent, with almost 30 percent of this increase made up of rental units in single family homes.

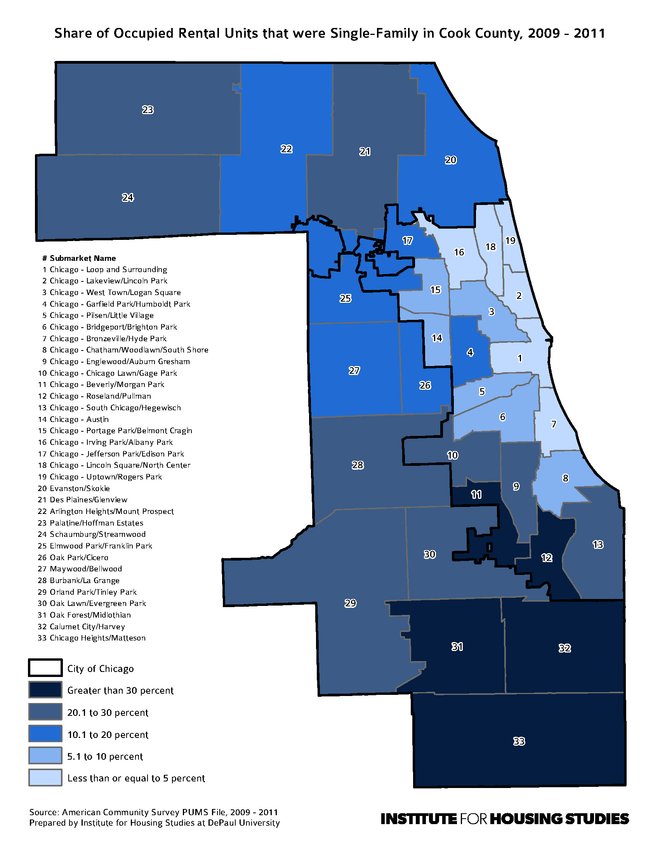

The map below illustrates the share of occupied rental units that were in single family homes in Cook County in a sample period between 2009 and 2011. It shows that single family rental homes accounted for more than 30 percent of the total share of renter-occupied units in several submarkets and that these areas are largely concentrated in south suburban Cook County.

Share of Occupied Rental Units that were in Single Family Homes in Cook County, 2009-2011

Share of Occupied Rental Units that were in Single Family Homes in Cook County, 2009-2011

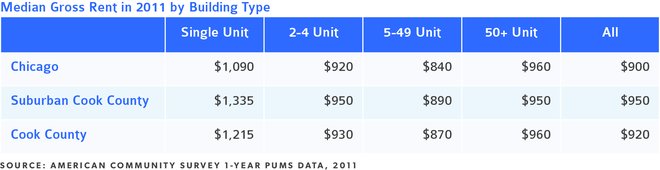

The table below shows how the influx of single family rental homes into the rental supply might have contributed to the growth of the affordability gap. It shows median gross rent in 2011 in Cook County by building type. These figures include not just the cost of rent but also the average monthly cost of utilities if paid by the renter. In the City of Chicago, the median gross rent for single family units is 21 percent more than the median gross rent of all rental units. In suburban Cook County, rents in single family rental units are 41 percent more than median gross rents of all rental buildings.

Median Gross Rent in 2011 by Building Type

Median Gross Rent in 2011 by Building Type

Whether the increased demand for affordable rental is being driven by the mismatch between the rents required by single family rental homes and those affordable to lower-income renters and whether this is a long- or short-term trend are important questions for researchers and policy makers. Given that it is likely that a significant share of the single family homes that have recently entered the rental stock have been purchased and converted to rental by investors, the business strategies of these investors could have a major impact on renters across income groups. Just as investors’ business strategies met growing demand for rental with conversion of owner-occupied single family homes to rental properties, as demand and populations shift, large quantities of this stock may be brought back to the market for sale as owner-occupied homes. The timing and quantity of these single family homes re-entering the market will likely to have a significant effect on local housing markets.

Look for continued IHS reports and blog posts on the role of single family homes in Cook County’s rental stock, the impact of investors in the single family rental market, and what impact both of these things have on rental affordability.

To be notified about new blog posts and to give us feedback, follow us on twitter, like us on Facebook, or join our LinkedIn Group.