Following the collapse of the subprime mortgage market and the onset of the U.S. foreclosure and global financial crisis, Cook County’s housing market has been one of the weakest in the nation. This weakness has been caused by a consistent and growing supply of foreclosed properties entering the housing inventory at a time when both the demand for housing is weak and access to credit is limited. As a result, housing prices have declined dramatically, particularly in communities that have seen concentrated levels of foreclosure activity, while potential buyers interested in purchasing these properties are unable to get the financing they need to do so. However, these conditions also present opportunities for homebuyers who have cash on hand and for investors looking to take advantage of low prices and the growing demand for rental housing.

This analysis examines residential property sales activity in Cook County from 2005 to2011 and explores the role that cash buyers are playing in different segments of the County’s housing market. This analysis sets a baseline for future research into the importance of access to credit and the impact of investor activity on neighborhood recovery.

Download the Cash or Credit: The Role of Cash Buyers in Cook County's Housing Market Research Report or Fact Sheet.

Key findings include:

- Between 2005 and 2011, declining residential sales volumes in Cook County were driven by decreases in mortgage lending. Between 2005 and 2011, financed home purchases declined by 76 percent and all-cash purchases increased by 12 percent. By 2011, 45 percent of the total residential property sales in Cook County were cash purchases, up from just under 15 percent in 2005.

- Cash buying is dominant in communities heavily impacted by the foreclosure crisis. Nearly 70 percent of residential property sales were completed using cash in high-foreclosure areas in 2011, compared to roughly 30 percent of residential sales in low-foreclosure communities.

- In 2011, high foreclosure areas had the largest share of distressed sales. Nearly 58 percent of the purchases in high foreclosure areas were sold out of a distressed situation. By comparison, about 44 percent of sales in areas of moderate foreclosure activity were distressed and 17 percent in areas with low levels of foreclosures were distressed.

- The vast majority of REO sales were purchased with cash. In 2011, 74 percent of sales out of REO status were completed using cash. In high foreclosure areas, nearly 90 percent of purchases out of REO status were with cash compared to roughly 71 percent in moderate foreclosures areas and 56 percent in low foreclosure areas.

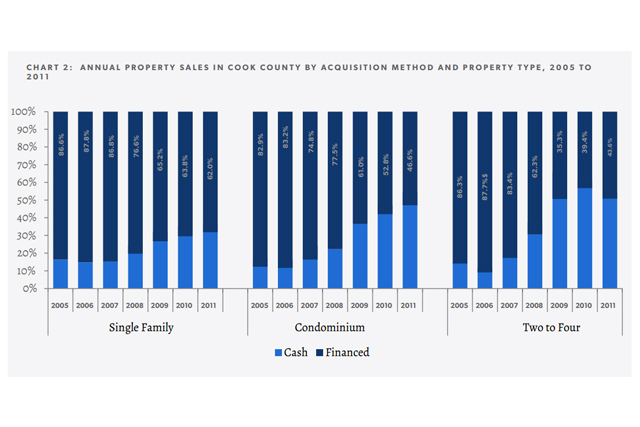

- The market for two-to-four unit buildings and condominium units has been increasingly dominated by cash buyers. Between 2005 and 2011, the share of two-to-four unit buildings purchased with cash increased by nearly 43 percentage points from roughly 13 percent in 2005 to 56 percent in 2011. The share of condominium units being purchased using cash increased by roughly 36 percentage points over the same period from 17 percent in 2005 to 53 percent in 2011. By comparison, the share of one-unit detached homes being purchased using cash increased by 25 percentage points from 13 percent in 2005 to 35 percent in 2011.

- The number of very low-value cash purchases increased dramatically after 2008 in high foreclosure communities. In 2009, nearly 25 percent of sales of one-unit detached and two-to-four-unit buildings in high foreclosure areas were cash transactions of less than $20,000. In 2010 and 2011, the share of transactions that were very low-value declined slightly but remained near or above 20 percent.