Single family house prices in Cook County continued to show improvement in the first quarter 2014, led by strong price growth in the City of Chicago. Prices in suburban Cook County also saw annual price increases, but grew at a slower rate than in the city. Areas heavily hit by foreclosure during the housing crisis showed the most significant increases. Despite positive recent price trends in these hard-hit neighborhoods, long-term house price levels in these areas still significantly lag those in other, less distressed parts of the county.

Key Trends from First Quarter 2014

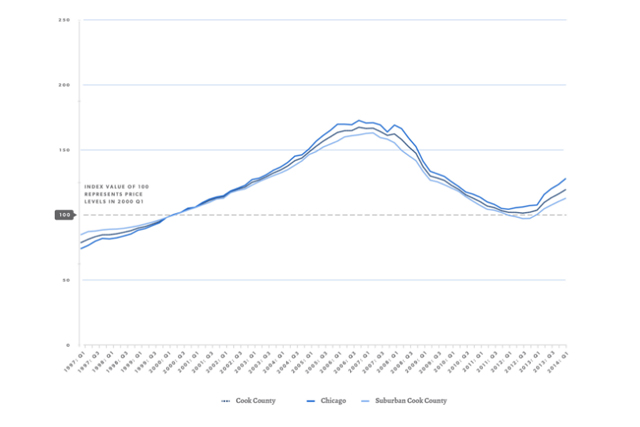

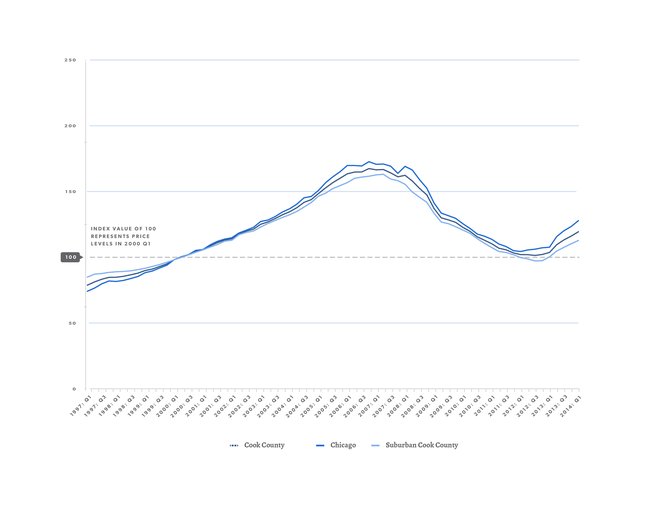

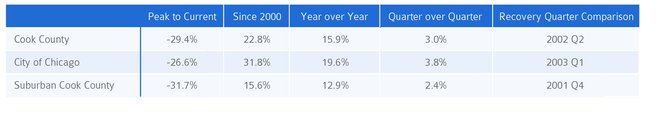

In the first quarter of 2014, single family home prices in Cook County saw their largest year-over-year increase since at least 1998. Figure 1 shows long-term price trends in Cook County and tracks house prices in the City of Chicago and in suburban Cook County separately. House prices in Cook County increased 16 percent compared to price levels in the first quarter of 2013. This was the third straight quarter where the county experienced record year-over-year price gains. This quarter's increase was led by gains in the City of Chicago, where year-over-year prices increased by nearly 20 percent. This is compared to suburban Cook County, where single family house prices increased by roughly 13 percent. Despite positive gains, prices in Cook County remain at levels similar to the second quarter of 2002. Single family home prices in the city are at pre-crash levels last seen in the first quarter of 2003, while prices in suburban Cook County are at fourth quarter 2001 levels. See Figure 2 for recent Cook County price-trend data.

Figure 1. Price Trend for Single Family Homes from Q1 1997 to Q1 2014

Figure 1. Price Trend for Single Family Homes from Q1 1997 to Q1 2014 Figure 2. Change in Prices of Single Family Homes from Q1 1997 to Q1 2014

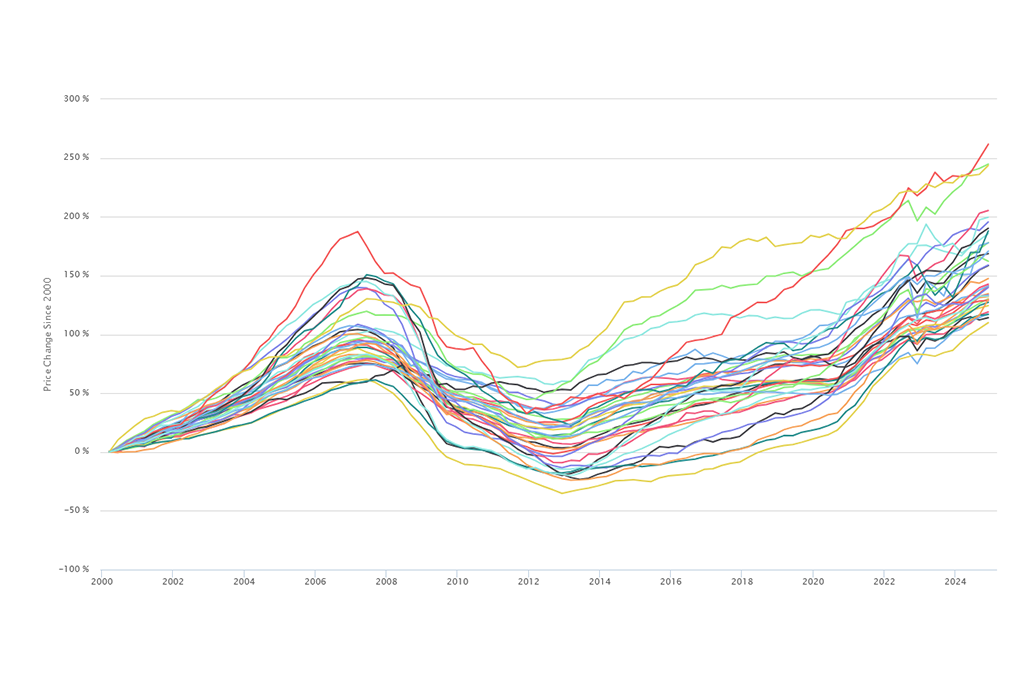

Figure 2. Change in Prices of Single Family Homes from Q1 1997 to Q1 2014

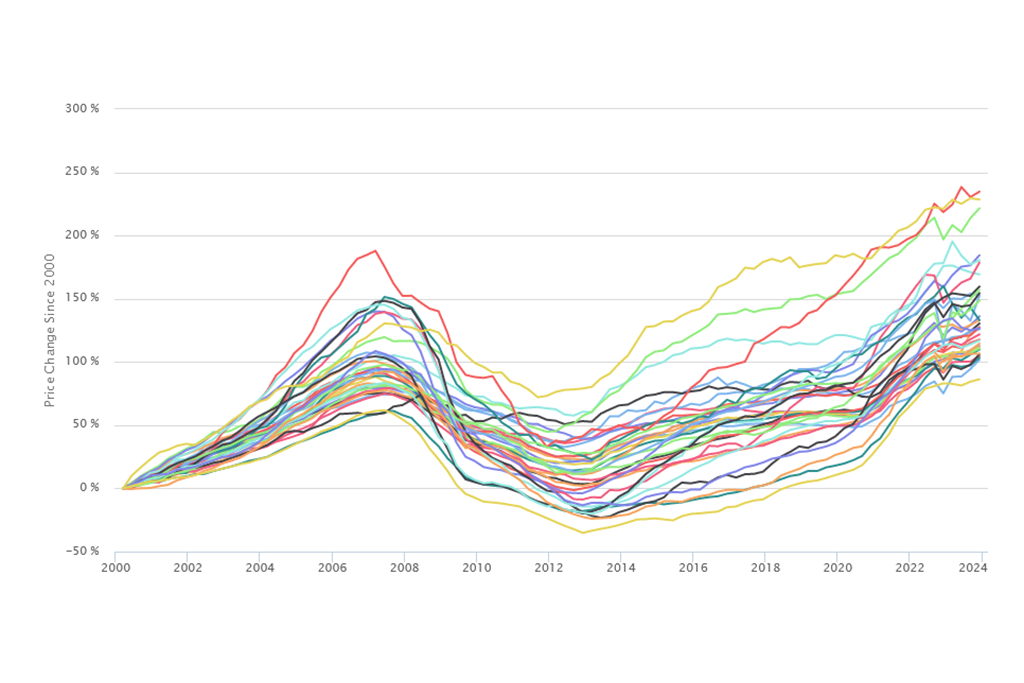

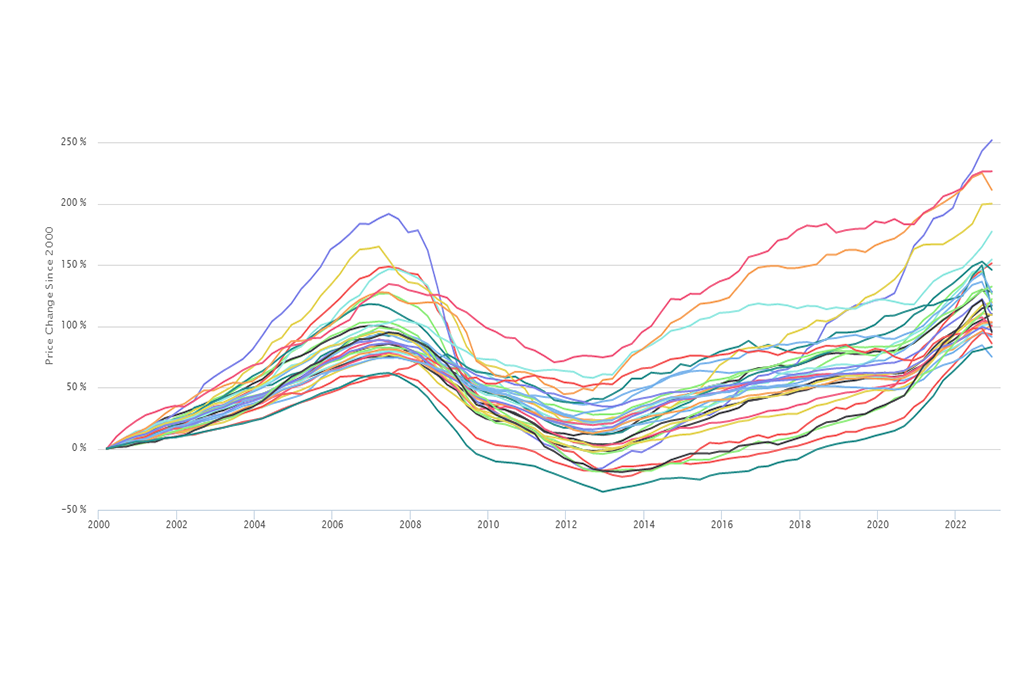

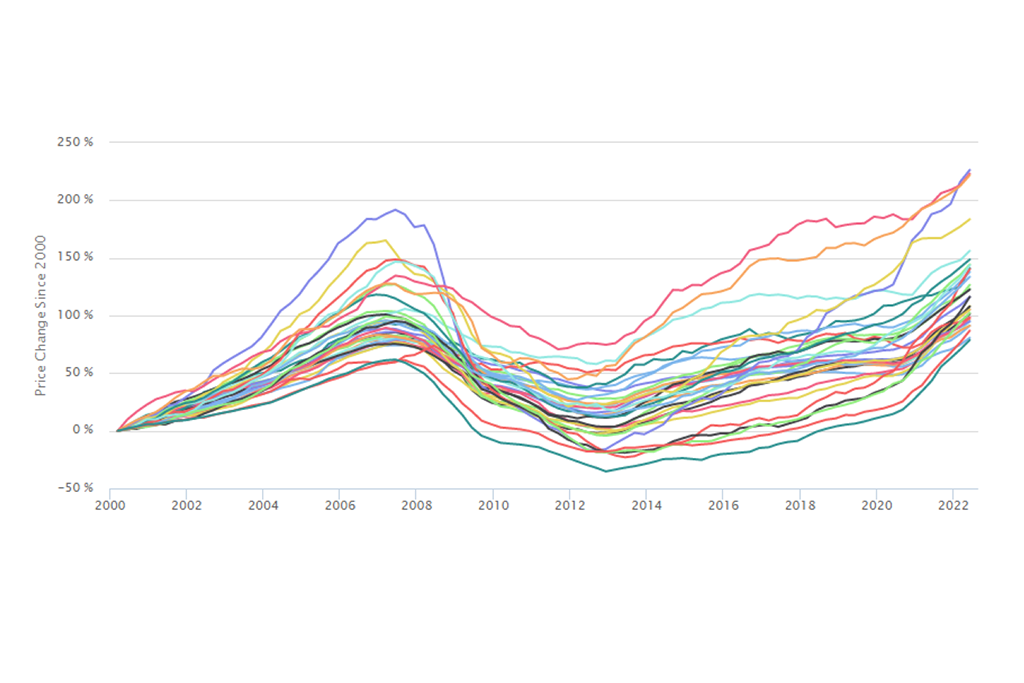

Neighborhoods hardest hit by foreclosure saw the largest annual price increases. Figure 3 shows long-term price trends for Cook County neighborhoods segmented by the degree to which they have been impacted by foreclosure. It shows that while all areas continued to see improving price levels, high foreclosure areas saw the most significant recent gains. In these areas, prices increased by more than 30 percent year over year and by nearly 10 percent since last quarter. This is compared to areas with the lowest-levels of foreclosure distress where prices increased 15.5 percent year over year and 3 percent since the fourth quarter 2013.

Figure 3. Price Trend for Single Family Homes in Cook County by Neighborhood Foreclosure-Distress Level, Q1 1997 to Q1 2014

Figure 3. Price Trend for Single Family Homes in Cook County by Neighborhood Foreclosure-Distress Level, Q1 1997 to Q1 2014

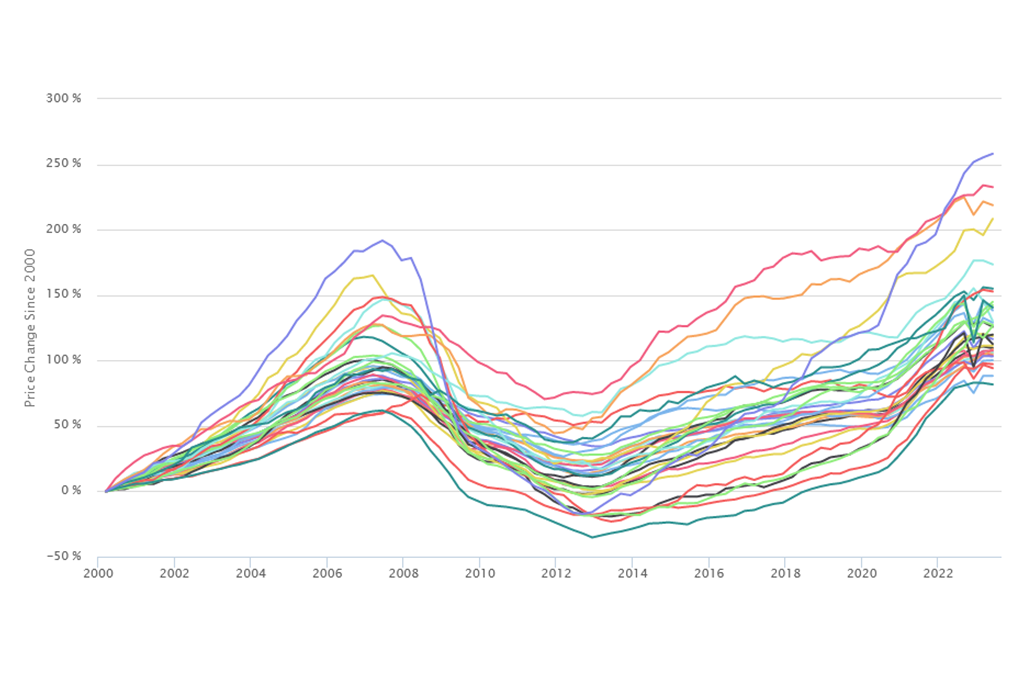

Figure 4. Price Change for Single Family Homes in Cook County by Neighborhood Foreclosure-Distress Level, Q1 1997 to Q1 2014

Figure 4. Price Change for Single Family Homes in Cook County by Neighborhood Foreclosure-Distress Level, Q1 1997 to Q1 2014

Despite significant year-over-year increases in single family house prices in the most foreclosure distressed areas of the county, prices remain well below 2000 levels and lag behind the rest of the county. In highly foreclosure-distressed areas, house prices are 55 percent below previous peak levels and roughly 23 percent below levels observed in 2000. Conversely, Figure 2 shows prices countywide are nearly 23 percent above levels observed in 2000. In the strongest markets with more limited foreclosure activity, price levels in the first quarter of 2014 were nearly 47 percent above levels observed in 2000. Single family home prices in these stronger markets are roughly 10 percent below levels observed at the peak of the housing market in the first quarter of 2007. See Figure 4 for recent price trend data by neighborhood foreclosure level.

Discussion

Although both the City of Chicago and suburban Cook County housing markets continue to show positive year-over-year increases in the first quarter of 2014, price growth is slower in suburban Cook County. The most foreclosure-distressed areas of the county continue to show significant price improvements, likely as a result of a clearing of distressed inventory and resales of previously foreclosure-distressed properties bought at lower values. However, price levels in these neighborhoods are 55 percent below peak and remain below levels recorded by the index since 1998 - indicating that these areas have a long road to full price recovery.

About the Index

The First Quarter 2014 IHS Cook County House Price Index is calculated from data on single family properties with repeat sales from the first quarter of 1997 through the first quarter of 2014. This release of the Index focuses on quarterly price changes for single family homes and tracks the variation in price changes between areas that have experienced different levels of concentrated foreclosure activity throughout the housing crisis.

Neighborhood foreclosure levels are determined by the share of residential parcels that have had at least one foreclosure filing between 2005 and 2012. Areas with low levels of foreclosure distress are neighborhoods where less than 10 percent of all residential parcels have had at least one foreclosure filing between 2005 and 2012. Areas with moderate levels of foreclosure distress are those where between 10 and 24.9 percent of all residential parcels have been directly impacted by foreclosure. In areas with high levels of foreclosure activity, more than 25 percent of residential parcels have had at least one foreclosure filing between 2005 and 2012. See the Second Quarter 2013 Price Index for a map of neighborhoods in Cook County that fall into each of these groups.

For a detailed description of how the IHS Cook County House Price Index is calculated, click here. For each release of the Index, tabular data is available for download. The numbers reported here are seasonally adjusted. For access to all downloadable materials, click the download link at the bottom of the page.