By: James D. Shilling

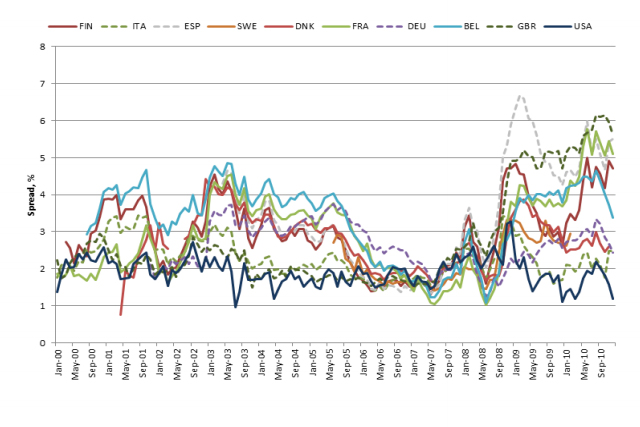

ABSTRACT: The purpose of this paper has been to provide evidence on the economic benefits of the federal government’s takeover of Fannie Mae and Freddie Mac. In theory, there are reasons to think that the government’s takeover of Fannie Mae and Freddie Mac has lowered mortgage rates in the U.S. and made housing relatively more affordable compared with affordability elsewhere. However, previous studies have yet to examine whether the takeover of Fannie Mae and Freddie has lowered homeowner borrowing costs in the U.S., or if these changes have had an effect on housing affordability. One reason for the dearth of empirical investigations on this issue is the fact that residential mortgage terms vary greatly from country to country. These differences make cross-country comparisons difficult to perform. The current paper develops a methodology that uses synthetic mortgage yield data in different countries to test whether homeowner borrowing costs are lower in the U.S. compared with costs elsewhere. The test is then applied bilaterally vis-`a-vis 13 foreign countries (United Kingdom, Canada, Germany, Denmark, Switzerland, Spain, Belgium, France, Australia, Italy, Japan, Sweden, and Finland, with the U.S. as the reference country) for January 1998 to December 2010. I generally find that the average mortgage rate in the U.S. today would be about 1.59% higher if a public Fannie Mae and Freddie Mac with explicit government guarantees were taken out of the equation. I also find that, in the absence of a private Fannie Mae and Freddie Mac, mortgage rates today would be only about 0.84% higher in the U.S. These results allow me to carry out a simple counterfactual exercise. First, I construct an in- sample backcast of the mortgage rate in the U.S. under two counterfactual situations: the absence of public Fannie Mae and Freddie Mac, and the absence of private Fannie Mae and Freddie Mac. Second, I construct a counterfactual housing affordability index that would arise in the absence of public and private Fannie Mae and Freddie Mac.

Assuming no change in house prices or housing demand, the simulations suggest that a public Fannie Mae and Freddie Mac have probably raised housing affordability in the U.S. by about 15% in the current environment. If instead housing prices are treated as endogenized, the analysis suggests that the rise in mortgage rates and fall in house prices net out almost to the same affordability. However, in the latter situation charge-offs and single-family residential loan delinquencies would have been much higher since house prices would have been lower.