A critical component of the Institute for Housing Studies’ (IHS) applied research model includes technical assistance to community groups and custom data analysis that illustrates different factors behind changing neighborhood dynamics. These data can provide a greater understanding of the reasons behind neighborhood change, provide evidence that amplifies the day-to-day experiences of community members, and inform community-led conversations to identify priorities and strategies.

IHS provides data and technical assistance for Communities United (CU)— a community-based organization based in Albany Park which also serves Austin, Belmont-Cragin, Roseland, and West Ridge, on the Northwest, West, and South sides of Chicago— and its housing initiative Renters Organizing Ourselves to Stay (ROOTS). This blog highlights some of this work and how it has been used by Communities United. To explore previous blogs in this series, such as our recent post on our partnership to enhance community data capacity and inform redevelopment strategies in Greater Chatham, click here.

About ROOTS

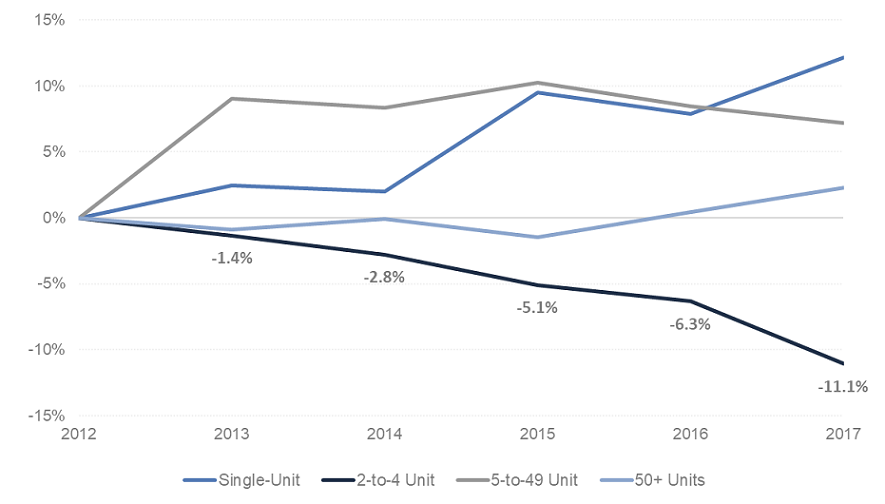

Communities United’s affordable housing initiative Renters Organizing Ourselves To Stay (ROOTS) works to prevent the displacement of low-income families through the development of a model to preserve affordable housing – specifically 2 to 4 unit buildings – in neighborhoods across Chicago. As Figure 1 shows, 2 to 4 unit buildings have been disappearing from Chicago’s rental stock. The organization works with a number of partners, including the Chicago Metropolitan Housing Development Corporation, Enterprise Community Partners, The Preservation Compact, Neighborhood Housing Services of Chicago, and the Cook County Land Bank to purchase and preserve affordable housing options in Chicago. To date, ROOTS has helped put 400 rental units into the preservation pipeline, and the organization’s efforts contributed to the City of Chicago’s Preserving Existing Affordable Rentals (PEAR) program. Currently, Communities United is looking into the effects of the COVID-19 economic disruption on low-income renters and on Chicago’s affordable housing stock.

Figure 1: Indexed change in rental units by building size in the City of Chicago, 2012-2017

Source: U.S. Census Bureau, Public Use Microdata Sample (PUMS)

Using Data and Community Partnerships to Preserve Foreclosed Buildings

Rental affordability has always been a key concern for Communities United. The organization helped pass the Keep Chicago Renting Ordinance in 2013, which required owners of foreclosed buildings to either allow renters in the building to renew their rental agreement with a rent increase of no more than two percent or pay tenants a $10,600 relocation fee. The ROOTS initiative was created to compete with cash investors who were displacing residents and buying foreclosed (largely 2 to 4 unit) buildings in the neighborhoods where Communities United operates.

“Our housing leaders had an emergency meeting and we asked ourselves the question: what could we do to even the playing field that the cash investor had by buying our properties?” said Diane Limas, board president of Communities United.

Through ROOTS, Communities United brought together developers at Chicago Metropolitan Housing Development Corporation (CMHDC) and investors at Enterprise Community Partners to assist in the acquisition and rehab of foreclosed 2 to 4 flat properties. Elected officials and the Cook County Land Bank assisted in keeping these acquisitions affordable.

The Institute for Housing Studies (IHS) provided data to help ROOTS identify these properties and their foreclosure status. For example, 2 to 4 unit buildings make up 33 percent of the housing stock in Albany Park, and 21.3 percent of the residential housing stock has had at least one foreclosure since 2005.

“Through getting data from DePaul, we found out that Fannie Mae owned most of the 2 to 4 flat buildings in the areas that CU represents,” said Limas. “Congressional elected officials put a lot of pressure for Fannie Mae to reduce these properties, and the Cook County Land Bank assisted us in acquiring and holding properties that helped facilitate the donation tax credit that CMHDC needed to keep these affordable.”

ROOTS considers households that pay more than 30 percent of their income on rent to be rent-burdened. Using data provided by IHS on the state of rental housing in Chicago, ROOTS did a rent burden study for the city. They found that almost 300,000 households in the city were rent-burdened, and 80 percent of rent-burdened households were low income, earning less than 50 percent of the area median income.

Working in CU’s communities, ROOTS preserved 42 units in 21 buildings as affordable housing, and renters in these units are expected to save more than $2,300 annually compared to market rents. The ROOTS model was used by the City to design its own preservation initiative, Preserving Existing Affordable Rentals (PEAR).

“The city put together their own initiative called PEAR, and that is based on our ROOTS initiative,” said Limas. “And we, CU and other organizations, were able to convince the city to put PEAR in the five-year plan with a $10 million budget.”

More recently, through ROOTS, CU has partnered with Preservation Compact and Neighborhood Housing Services to consider the use of accessory dwelling units (ADUs) to add units to the affordable housing stock. IHS provided the ROOTS initiative with data on how many 2 to 4 flats were likely owner-occupied and detected patterns of longer-term ownership to help understand the potential impact of converting a garden unit to rentable space. Figure 2 displays likely owner-occupied parcels in Albany park in 2018 and identifies which of the parcels have been owner-occupied since before 2000.

Figure 2: The distribution of 2 to 4 unit housing stock, and length of ownership, in Albany Park, Chicago, 2018

“We were able to get data from DePaul concerning our 2 to 4 flats, and how many of them were owner-occupied, as we start talking to elected officials about ADUs and turning a basement unit into a 2 to 4 as a safe and healthy unit of rental space.”

Stabilizing Affordable Housing in an Uncertain Housing Market

As the housing market shifts due to the fallout of COVID-19 and renters and owners face significant financial hardship, Communities United is considering the impact that these changes will have on low-income renters across Chicago and the naturally occurring affordable units where they reside.

“What's going to happen to this small rental 2 to 4 flat owner as the renters can’t pay their rents?” said Limas. “Is he going to be able to continue to keep his building? Or is he going to be eager to sell again, to a cash investor that you know is going to be hitting our 2 to 4 flats?”

While companies operating larger apartment buildings may be more capable of weathering some of the short- and long-term losses due to the Coronavirus, owners of smaller buildings may be facing significant financial strain. Limas said that if many of these buildings are foreclosed in the aftermath of this crisis, further deterioration, disinvestment, and conversion of 2 to 4 units could displace many existing renters. IHS has worked with ROOTS to track conversion activity in Albany Park, mapping parcels that have changed class to single-family, non-residential use, and other residential uses (Figure 3).

“We already saw what happens, you know, through foreclosures with our 2 to 4 flats; we lost tons and tons of affordable units because of the deconversions, and in disinvested areas, because of the lack of investment in these areas, we lost our 2 to 4s because of deterioration and disinvestment.”

Figure 3: Major class changes on 2 to 6 unit parcels in Albany Park, 2013 to 2018

Beyond employing the current preservation model to stabilize rents for low-income families, Limas said Communities United is looking into more legislation to protect and preserve affordable housing stock that could be hit hard by an economic recession. According to Limas, this may be an opportunity to renew a conversation with the City on protecting renters in these properties and making it harder for cash investors to buy and convert housing, suggesting that investors pay for each converted unit.

“If a cash investor wants to buy a 2 to 4 flat, and they want to deconvert it into a single-family home then they have to pay,” said Limas. “It costs $150,000 to preserve a unit of affordable housing. It costs over $300,000 if you want to create a new unit of affordable housing. So if you want it to be converted then you have to pay $50,000 for every unit that you are taking away from that building.”

Looking Forward

As the ROOTS initiative progresses, Communities United will continue to seek new data to answer new questions – including questions coming out of the developing COVID-19 crisis. Limas said these data are important both to inform ROOTS and to present the lived experiences of CU’s communities to elected officials.

“Everything depends on data and IHS provides excellent data,” said Limas. “Having reliable data to present to our elected officials is really crucial, and a way to really get them on your side, especially when you're working on legislation and you're trying to prove your case.”

For IHS, working with ROOTS has helped the Institute better understand the on-the-ground impacts of the loss of 2 to 4s, and further hone our research model by pushing us to find new ways to inform and provide analysis for community organizations working to address Chicago’s affordable housing challenges. As the economic disruption due to the Coronavirus begins to unfold, IHS will look to find new ways to develop indicators and analyses for partner organizations and the public to further investigate how these disruptions affect the housing market and Chicago’s vulnerable populations. To read IHS’s preliminary analysis examining the neighborhood-level housing impact of COVID-19 in Chicago, click here.