The growth of institutional investors as a dominant player in certain hard-hit housing markets may have implications for the recovery and stability of these markets in coming years. This post examines the recent activity of the top business buyers of single family homes in Cook County and highlights the emergence of a clear market leader.

Investors have taken advantage of both a large pool of low-priced, distressed properties available in areas hit by the foreclosure crisis and the growing demand for rental housing. These investors represent a range of business entities including some large publicly traded Wall Street firms. These large Wall Street investors have purchased at least 200,000 single family homes nationwide since 2011. Using data from IHS, the Chicago Tribune examined what having these large national firms as landlords meant for Chicago area communities.

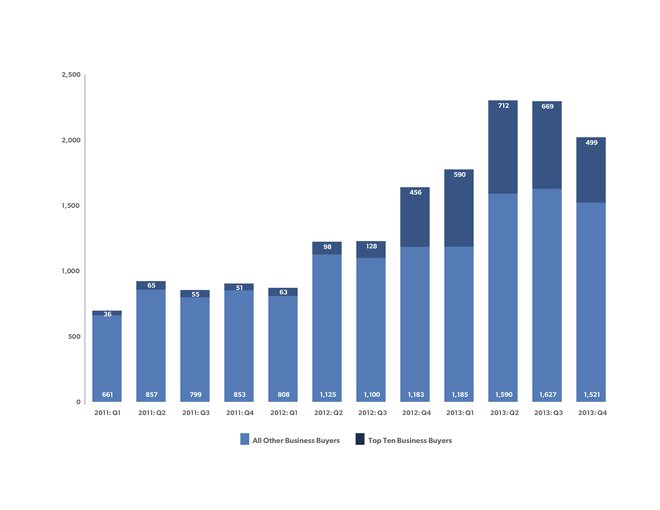

Ongoing IHS analysis of the most recent data of property sales activity in Cook County from the IHS Data Clearinghouse shows that purchases of single family properties by business buyers, and larger investors specifically, increased significantly in 2013. Figure 1 below shows quarterly levels of business buyer purchases of single family homes between 2011 and 2013 and highlights the activity of the ten most active firms during this period. It shows that single family business buyer activity jumped substantially in 2013 and that this increase was led by these ten most active firms, many of whom were larger, national investor groups new to the Cook County market.

Figure 1. Single Family Business Buyer Transactions in Cook County, 2011: Q1 to 2013: Q4. Source: IHS Data Clearinghouse.

Figure 1. Single Family Business Buyer Transactions in Cook County, 2011: Q1 to 2013: Q4. Source: IHS Data Clearinghouse.

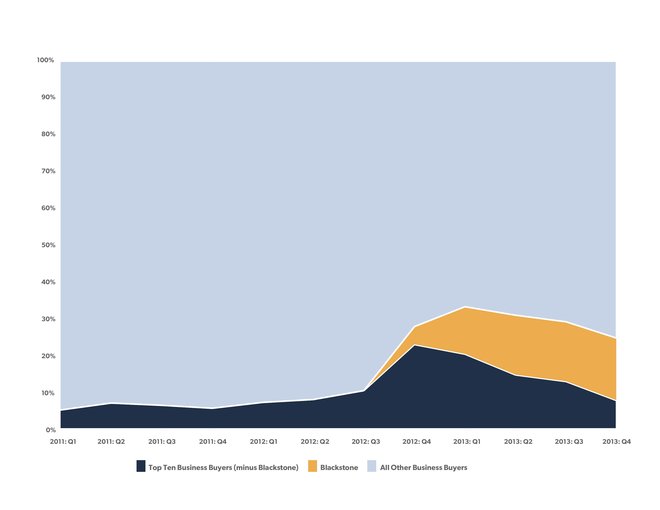

Further analysis shows that the increase in top-buyer activity seen in Figure 1 was largely driven by purchases of single family homes by just one company: the Blackstone Group. Figure 2 shows the composition of single family home purchases by business buyers between 2011 and 2013, with Blackstone's purchases tracked in yellow. Whereas Blackstone purchases only represented 4.9 percent of all single family homes bought by business buyers in the fourth quarter of 2012, their share was 17 percent of the total by the fourth quarter 2013 making them the clear market leader.

Figure 2. Composition of Single Family Transactions by Business Buyers in Cook County, 2011: Q1 to 2013: Q4

Figure 2. Composition of Single Family Transactions by Business Buyers in Cook County, 2011: Q1 to 2013: Q4

The Blackstone Group is a multinational, publicly traded, private equity firm based in New York City that has purchased approximately 44,000 homes nationally for an estimated $8 billion since April of 2012 . Like most institutional investors, Blackstone targeted areas with steep, post-housing bubble price declines, but, as prices in these areas increased, it began to move on from those markets to cities like Chicago where home prices were recovering more slowly. It markets these homes to renters under the name Invitation Homes.

What exactly do the patterns of investor-buying activity look like in Chicago?

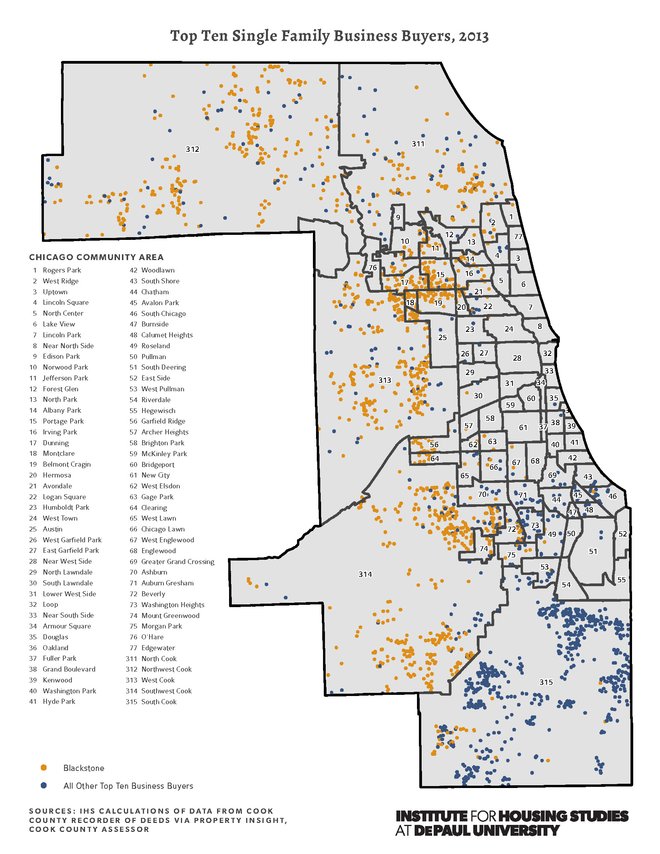

In the map below, you can see what the geographic pattern of Blackstone purchases looks like compared to other top ten business buyers in 2013. Blackstone concentrated much of its purchasing in north and west suburban Cook County, as well as City of Chicago Community Areas such as Belmont Cragin, Portage Park, and Dunning. While these areas were impacted by foreclosures and have seen price declines during the housing crisis, they are far less distressed than many of the county's hardest-hit markets. Comparatively, purchases made by the other top business buyers were more focused in foreclosure-distressed markets with steeper price declines on Chicago South Side Community Areas and south suburban Cook County.

Figure 3. Map of Top Ten Single Family Business Buyers in Cook County in 2013

Figure 3. Map of Top Ten Single Family Business Buyers in Cook County in 2013

This pattern of business buyer activity, particularly the dominance of one institutional owner in many neighborhoods, could impact both long-term housing market stability and housing affordability in these areas. In our next post we'll take a deeper look at the implications of concentrated business buyer activity in Chicago area neighborhoods and municipalities.

A follow up to this post, "Examining Patterns of Concentrated Institutional Investor Purchases in Cook County" was published on August 25, 2014, and can be found here.

To be notified about new reports as well as new blog posts, and to give us feedback, follow us on Twitter, like us on Facebook, and join our LinkedIn Group.