After Promising Job Growth, Economic Recovery Slows

Nearly nine months into the COVID-19 recession, experts predict that a full economic recovery may be slow, bumpy, and uneven. Job recovery is slowing momentum as new unemployment filings remain elevated, many laid-off workers face permanent job losses, and federal policymakers have yet to distribute another round of stimulus funds.

At the Institute for Housing Studies (IHS), our neighborhood-level analysis illustrates that the pandemic has heightened existing economic and housing insecurity for Chicagoans. Lower-income households, workers of color, and renters and homeowners with preexisting housing cost burdens were more likely to work in vulnerable occupations experiencing initial mass job layoffs.

This blog is part of our recent series examining the impact of the pandemic in Chicago neighborhoods and revisits how local, state, and federal policy interventions have evolved since June. Federal short term supports from the Coronavirus Aid, Relief, and Economic Security (CARES) Act have been critical for those able to access relief, but many of the CARES Act’s most critical economic supports have expired and stopgap measures to temporarily extend these programs have not been a panacea to alleviate the current economic hardship faced by many households.

A Short-Term Fix that Hits Pause on Looming Evictions and Foreclosures

Many struggling renters and homeowners found themselves in increasingly precarious positions as federal foreclosure and eviction protections enacted by the first coronavirus stimulus package expired this summer.

The Federal Housing Administration (FHA) and Federal Housing Finance Agency (FHFA) extended the federal foreclosure moratorium through the end of 2020, protecting an estimated 36 million homeowners with a federally back mortgage. Meanwhile, mortgage servicers have been modifying loan terms to bring homeowners current on their mortgage payments, such as allowing homeowners to add missed payments at the end of the loan term or pay missed payments at the point of sale.

The share of conforming mortgages in forbearance has fallen to a new low since the start of the pandemic but some homeowners may be at higher risk of foreclosure. The forbearance rate of Ginnie Mae mortgages held by lower- and moderate-income owners remains high and the share of seriously delinquent mortgages surged this summer.

Invoking their broad public health powers, the Centers for Disease Control and Prevention (CDC) reinstated a uniform national eviction ban that expands the number of protected tenants covered under CARES Act eviction protections by tying eligibility to renter household income rather than a rental property owner’s mortgage financing.

The CDC’s eviction ban came during a precarious time when an estimated 1 in 5 renters were at risk of eviction by the end of September. Renters were relying on a patchwork of stopgap state and local protections while some states did not establish any eviction protections and housing courts were starting to process a backlog of eviction filings.

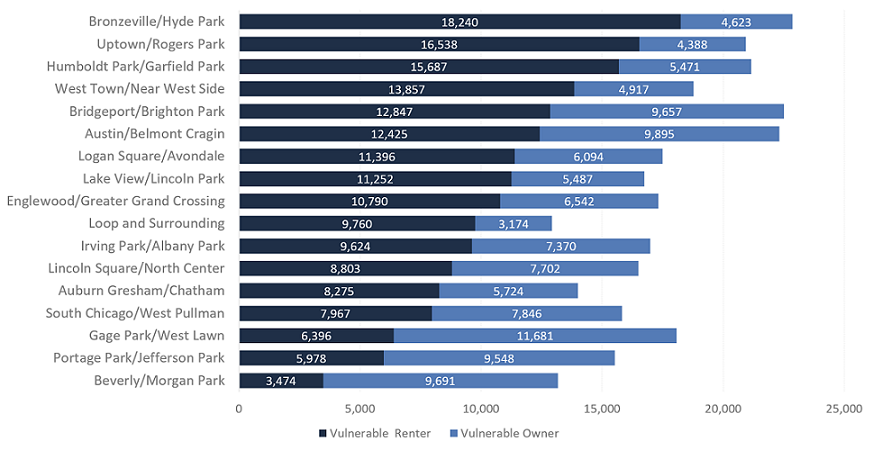

Keeping vulnerable households at risk of displacement in their homes is a critical public health intervention during the pandemic but the federal eviction moratoria does not address accumulating rent arrears, which could reach an estimated $25.1 to 34.3 billion by the end of the year. Many have also pointed out that eviction moratoria are not solving the problem, but rather postponing it. Once the eviction ban expires on January 1st 2021, an estimated 760,000 renter households may be at risk of eviction in Illinois alone while the possible wave of evictions is likely to manifest disproportionately across certain Chicago communities (Figure 2). IHS’s analysis of communities at risk of being hit hardest by initial COVID-related job losses show that a high share of residents living in communities across Chicago’s West and South sides and Cook County’s near north and south suburbs are at heightened risk of being unable to pay for their housing costs.

Figure 2. Chicago Renters and Owners Risk of Housing Nonpayment Varies across Submarkets

Number of Potentially Impacted Working Households in Occupations Vulnerable to Initial COVID-19 Layoffs by Tenure and City of Chicago PUMA Submarket

Source: 2018 ACS Microdata, IPUMS USA, IHS calculations based on code developed by NYU Furman Center

Small Landlords are Struggling, Too

Landlords of smaller rental buildings, an important source of affordable housing in Chicago and nationwide, are also struggling to pay their bills. Renters working in industries with higher rates of unemployment are more likely to live in these smaller rentals but landlords of these properties have fewer policies at their disposal to weather a long-term drop in rents. They often do not have a large enough number of employees to qualify for the Payment Protection Program, are less likely to have federally-backed mortgages to access forbearance options, and have shallower reserves to dip into in times of crisis. Surveys have found that 25-30 percent of small landlords are tapping into savings as a result.

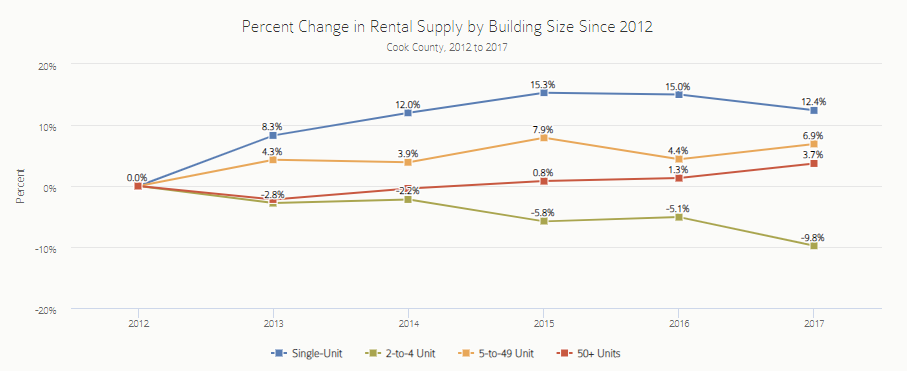

IHS analysis shows that Cook County's rental units located in 2 to 4 unit buildings have steadily decreased since 2012, likely due to vacancy, and demolition in weaker markets and through conversion to single-family homes in stronger markets (Figure 3). Preventing these properties from foreclosure and falling into the hands of larger investors is crucial to support a resilient affordable housing ecosystem, particularly in communities that have a significant unsubsidized affordable housing stock. Landlords of 2 to 4 unit rentals provide relatively more affordable rents and are more likely to house lower-income households. The typical household income of a tenant in a typical 2 to 4 rental is $35,500 – the lowest income among households renting single-family, 5-to-49 unit, and 50 or more unit properties.

For a longer-term solution that provides stability for vulnerable renters and rental property owners, affordable housing advocates and industry groups are both are calling for large-scale rental assistance. A dedicated stream of funding can address the potential threat of eviction resulting from nonpayment of rent, allow property owners to resume adequate property maintenance and operations, and alleviate the potential risks of foreclosure.

The revised Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act calls for $50 billion in emergency rental assistance distributed through Emergency Solutions Grants to help lower- and moderate-income renter households pay for back rent and future rent-related costs. Flexible federal funding sources from the Federal Emergency Management Agency (FEMA) and Community Development Blog Grant (CDBG-CV) have allowed localities to directly disburse rental assistance on behalf of tenants to landlords, ensuring tenants who face challenges receiving benefits are protected.

Figure 3. Cook County has been Experiencing a Steady Loss of Rental Units in 2 to 4 Unit Buildings

A Lapse in Unemployment Benefits Threaten Housing Stability

Amid high unemployment rates, laid-off workers have relied on expanded unemployment benefits to pay for housing costs and everyday necessities. Workers that started receiving extended unemployment benefits at the start of the pandemic will be nearing the end of assistance this December while the $600 weekly federal supplement expired in late July.

State and federal stopgap measures have helped avoid a lapse in unemployment benefits, but these measures are temporary. The Illinois Department of Employment Security extended the duration of unemployment assistance by 20 weeks for workers that have already exhausted the typical 26 weeks and the President signed an executive order that provides a $300 weekly supplement using FEMA’s Disaster Relief Fund, funds that were set to last four or five weeks.

Continued unemployment benefits and cash assistance remains critical during a time when the pace of economic recovery is slowing. Recent studies have shown that the expansion of unemployment benefits and the one-time stimulus payment prevented a record high rise in poverty. Despite this, individuals and families are struggling – food insecurity and hunger have risen among families with children and seniors.

In the absence of any federal weekly supplement, an estimated 70 percent of renter households that experienced COVID related job losses nationwide could become housing cost-burdened, with 46 percent paying more than half of their income on rent. Even for those that are currently paying rent in full, many are relying on savings, credit card debt, payday and emergency loans, and family and friends.

Rollout of Local and State Emergency Housing Assistance Keeps Households Afloat

From an infusion of federal funding and partnerships with nonprofit and philanthropic organizations, local and state agencies have rolled out emergency rent and mortgage relief programs. The City of Chicago’s Department of Housing and Family and Support Services expanded its Housing Assistance Grant Program to help 10,000 lower- and moderate-income households pay for missed rent and mortgage payments. Cook County Government created a similar housing assistance program for suburban renters and homeowners that have lost their jobs due to the pandemic. Lastly, Illinois Housing Development Authority’s (IHDA) $150 million program is the largest rent relief program in the country and serves residents across the state.

Washington is guiding an equitable distribution of rental assistance to help ensure federal dollars are having the largest impact in communities that need it the most. The state requires counties to allocate rental assistance funds based on the share of people of color living under the poverty line and prioritize assistance to lower-income tenants and people who have either experienced homelessness or an eviction.

Organizations administering existing affordable housing programs have used established programs to distribute COVID housing assistance. Massachusetts’ Residential Assistance for Families in Transition rental assistance program has been in place for sixteen years as a homelessness diversion program and served as a template to get the state’s COVID Emergency Rental and Mortgage Assistance program off the ground. Vermont’s Champlain Housing Trust has been acquiring properties to convert as affordable housing, including a motel to combat the rising costs of short term housing in the area and provide wraparound services to people at risk of homelessness. At the onset of the pandemic, they were able to use the motel to shelter symptomatic people experiencing homelessness.

Additional rounds of rental assistance are needed to meet the scale of growing housing insecurity. Across the state, IHDA saw twice as much demand for housing relief than the number of households they can serve from the first round of CARES Act funds.

No Short-Term Fixes during Uncertain Economic Times

Affordable housing advocates and practitioners often work at the local level against macro-level challenges. Today’s economic downturn risks reversing important community development work in communities that have just started to recover since the Great Recession. Policy interventions that stabilize our local housing markets and provide longer-term economic security for struggling residents can build upon local affordable housing work and advance a more equitable recovery process.

IHS is actively collaborating with partners to leverage applied research and stakeholder engagement to inform innovative policy development to mitigate the local impacts of COVID-19 on our communities. In the early months of the pandemic, IHS and the Preservation Compact formed the Preservation Lab and convened local affordable housing leaders to better understand the potential impacts of COVID-19 and discuss how rental assistance programs can better serve the needs of vulnerable tenants and property owners.

In the coming months, IHS will develop new analyses to help regional stakeholders understand the potential scale and patterns of a COVID-19-related economic downturn on local housing markets and continue to work with community partners to develop new data indicators and tools to support their work on the ground. To keep up-to-date on IHS analysis, sign up for our email list, follow us on Twitter, Facebook, or LinkedIn.